Institutional layer for RWA Yield

Setmos gives access to real-world assets income flows -all in one place.

One Platform.

Multiple tokenized income Streams.

Selection from the most trusted RWA products

Diversified curated access to APY asset income

Capital Growth with the modern technology

Bridging traditional finances with tokenization on blockchain

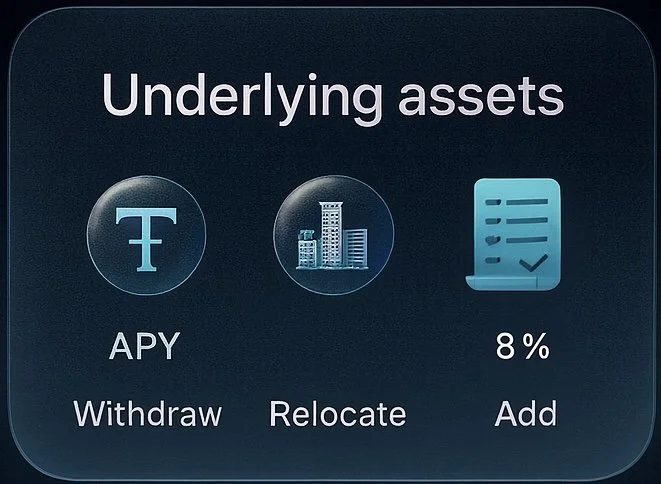

Set_Options from U.S. Treasuries to Private Credit

Setmos protocol is bridging liquidity with real-world yield markets, enabling direct access to institutional-grade income products

Investors gain exposure to short-term U.S. Treasuries, trade finance and other collateralized assets —

all through a unified on-chain ecosystem

-

Designed for optimized global execution .Our architecture is built as fast orchestration cluster with multiple parties involved

-

Direct share in diversified,collateral-backed financial income pools

-

All transactions recorded onchain, ensuring transparency and enterprise-grade security

Built on Stellar.Powered by regulated stablecoin USDC.

Be among the first institutions to access tokenized financial RWA